22 Mar Casual Overtime Changes … what do they mean for you?

By Penny Stirling, HR Consultant, Girardi Human Resources

On 30 October 2020, the Fair Work Commission announced changes to the casual and overtime clauses in 97 Modern Awards. Keeping up to date on compliance issues is a never-ending task. It’s easy to miss changes such as these, which leaves you vulnerable to underpayments that can drain your time and energy to rectify.

But what does that mean for you?

If you made no changes, then you may be underpaying staff, and the longer this goes on, the more you will need to backpay to fix it.

Below are the top 6 things to do to check if your business is up to date, compliant and keeping your casual workforce happy!

- Is your award one of the 97 affected by the changes? This list will let you know, but some common awards affected are those relating to building and construction, plumbing, child care workers, the contract cleaning industry, fitness industry workers, hair and beauty industry and employees in the general retail industry.

- Determine the span of ordinary hours applicable in your award. The span of ordinary hours covers the earliest and latest times in the day where the employee can work without payment of overtime (ie 6.00am-6.00pm). If your business operates outside these hours and your employees are rostered to work outside these hours, then you need to be paying overtime rates.

- How many hours per day/week are your casual employees working? All awards will outline the maximum number of hours per day that may be worked by employees. Commonly this will be between 8-12 hours in a 24-hour period (though your award may differ). When a casual employee works more than 38 hours in a week, they will be entitled to overtime rates.

- Determine the overtime rate calculation for your award. The Fair Work Commissioner outlined changes to the wording within awards to define the rate that applies. There are three ways overtime may be calculated – for example the first 2-3 hours may be payable by substitution (150%), cumulative rate (175%) or compounding rate (187.5%). This calculation is differs between awards so it is essential to check the specific wording within your award as it applies to you.

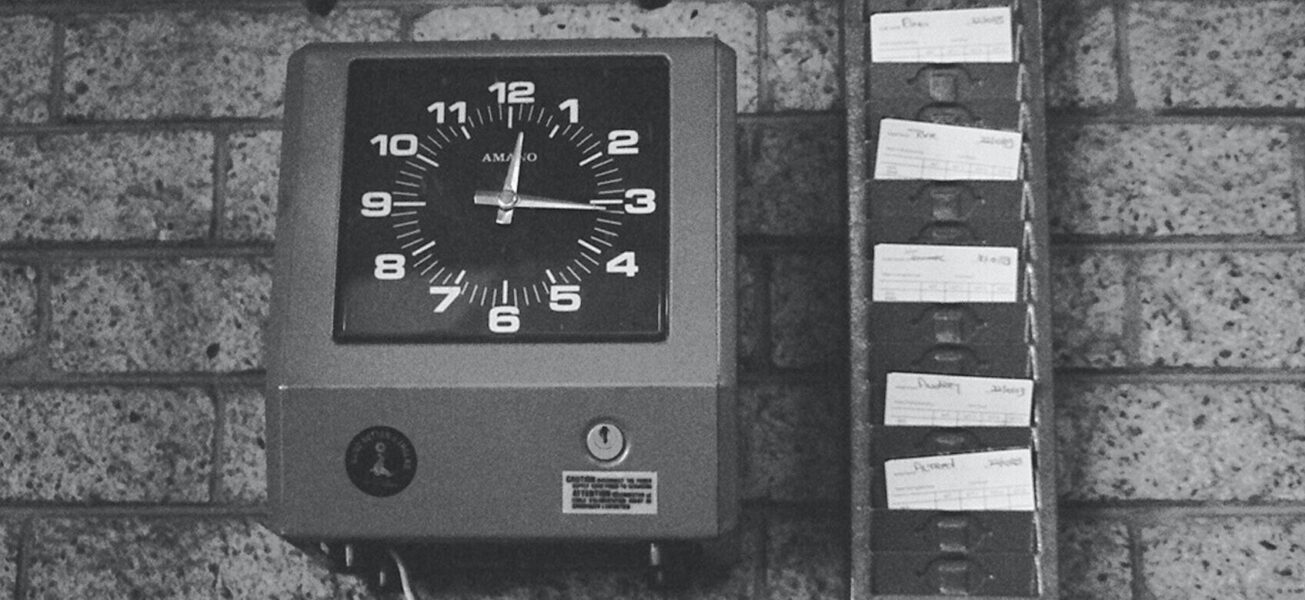

- The updated clauses in most awards started from the first full pay period on or after 20 November 2020. If you determine that you are required to pay casual employee overtime, then look back over your employee timesheets (issued after 20 November 2020) to determine any backpay due to employees.

- Getting it right from here on. Consider making changes to your employee time sheet to easily track the overtime payable to employees or make changes to your operating hours to avoid the need for overtime.

Maintaining a stable workforce is everyone’s responsibility – lets get it right together!

No Comments